Generative AI-Powered Medicare: Maximizing Broker & Agent Efficiency

By 2030, Medicare enrollment is anticipated to reach a staggering 80 million. However, a striking 90% of agents currently resign or leave their roles within their first year.

We hosted a panel discussion to highlight the challenges, and uses cases for Generative AI with groundbreaking tools like Tabor that are revolutionizing the Medicare sector. We addressed how AI can facilitate agent onboarding, streamline the enrollment process, and proactively engage with clients.

You can watch the full discussion here. Below is a condensed summary of the hour-long panel discussion.

The Panelists

Dianne Faligowski, with 18 years of experience in the Medicare field, is the CEO of HealthPlans in Oregon and a Partner at Integrity Marketing Group. She began her career with life supplemental insurance before moving into Medicare in 2006, a field she is passionate about. Dianne finds joy in helping people navigate the complexities of choosing from around 40 different Medicare plans, acknowledging the challenge it poses for seniors.

Recently, her team has seen significant improvements in productivity and results, thanks to the adoption of Tabor. Dianne is proud and honored to be among the early users of Tabor and attributes her team’s success to its utilization.

Scott Reid, with over 30 years of experience, is a seasoned entrepreneur in the healthcare sector. In the first 20 years of his career, Scott focused on senior housing, striving to provide top-quality, enjoyable experiences for seniors in various stages of care, including independent living, assisted living, memory care, and skilled nursing.

In the latter half of his career, Scott shifted to managed care, notably as a co-founder of Alignment Healthcare. This venture, a Medicare Advantage Health Plan, was centered around a senior-focused model, prioritizing their care and well-being, integrated with a technological approach developed by his partner, Skypoint founder and CEO, Tisson Mathew.

Scott is currently a Partner and stakeholder in Tabor AI, which he believes offers a powerful solution, marking the next chapter of his entrepreneurial journey in healthcare.

The Medicare dilemma

Approximately 12,000 Americans turn 65 every day, totaling about 4 million annually. By 2030, this number is expected to reach 80 million. Despite the vast potential market, only about 100,000 out of 1.2 million licensed agents in the U.S. sell Medicare, and just 30% of these actively write policies. The opportunity is substantial, with agents earning $600 for the first year per enrollment and $300 annually for each subsequent year if the enrollee remains in their portfolio. However, there’s a high turnover rate, with 95% of agents resigning within their first year.

The challenge lies in the difficulty of starting and growing a Medicare business. Generating leads and building a client base are daunting tasks, often requiring creative and motivated efforts.

What are the factors driving high agent attrition rates in Medicare?

Dianne has observed thousands of agents in the industry, identifies several key reasons why many Medicare agents struggle or leave the field:

- Lack of Leads: Many agents either aren’t resourceful enough or lack efficient methods to generate a sufficient number of leads to sustain their business.

- Inadequate Training and Support: Especially crucial for new agents, the vast amount of data, plan details, policies, and coverage information can be overwhelming. A lack of comprehensive training from carriers, agencies, or Field Marketing Organizations (FMOs) often leads to frustration and quitting.

- Overextension with Multiple Insurance Products: Trying to sell too many types of insurance products, such as life, supplements, or final expense insurance along with Medicare, can be challenging due to the complexity of each product.

- Difficulty Adapting to Change: The constant changes in the industry, particularly in Medicare, which undergoes annual changes in certifications, sales, and marketing guidelines, can be hard to keep up with.

- Work-Life Balance: Starting and sustaining a new business in this field requires significant time and effort, making it challenging to maintain a balance between personal and professional life.

Meet Tabor – AI for Medicare

Tabor addresses these challenges by significantly simplifying the process for agents. What traditionally takes around 6 hours of work – understanding seniors’ needs and finding the best plan for them – Tabor accomplishes in about 10 seconds. The AI tool efficiently digests information and recommends optimal plans based on individual needs.

The mission of Tabor is to become the essential tool for all Medicare agents, aiding them in efficiently placing their clients in the most suitable insurance scenarios. This innovation not only benefits the agents in terms of productivity and ease of work but also ensures that seniors receive the best possible plans tailored to their specific needs.

Medicare’s income potential for agents

Reflecting on her own success, Dianne shared that she earned $75,000 in her first year in Medicare, reaching $1 million in less than four years. She believes that with AI tools like Tabor, new agents can achieve similar success more efficiently and quickly.

Scott added that AI is transforming the industry, especially for new agents who might be overwhelmed by the vast amount of information in Medicare. He asserts that AI tools like Tabor, which serve as a personal assistant, can help new agents rapidly advance to senior status. Reid views the adoption of AI in Medicare as inevitable, predicting that early adopters will thrive significantly, those who adapt moderately will survive, while those who resist the change may struggle to sustain their careers.

“It’s a self-fulfilling prophecy. Whether you agree with it or not, everybody is going to be using AI. It is the way of the future, and early adopters will succeed astronomically. The middle of the road will survive, and those that don’t won’t survive.” – Scott Reid

How is Tabor providing all that information for the agents and the brokers?

Tabor functions as a specialized ChatGPT large language model (LLM) focused specifically on Medicare and related policies across the United States. The model is continually updated with extensive information on Medicare plans, tailored to each county as defined by the Centers for Medicare & Medicaid Services (CMS). This involves processing a massive amount of documentation to track the various health plans for each county nationwide.

By ingesting this data into the large language model, Tabor becomes a highly efficient tool for agents, trained to provide detailed and specific answers about health plans in every U.S. county. It assists agents in various tasks, such as summarizing information, comparing plans, and updating coverage changes. Tabor can handle a range of inquiries, including provider portals, pharmaceutical details, and more, using publicly available data. It stands out for its precision, accuracy, and speed.

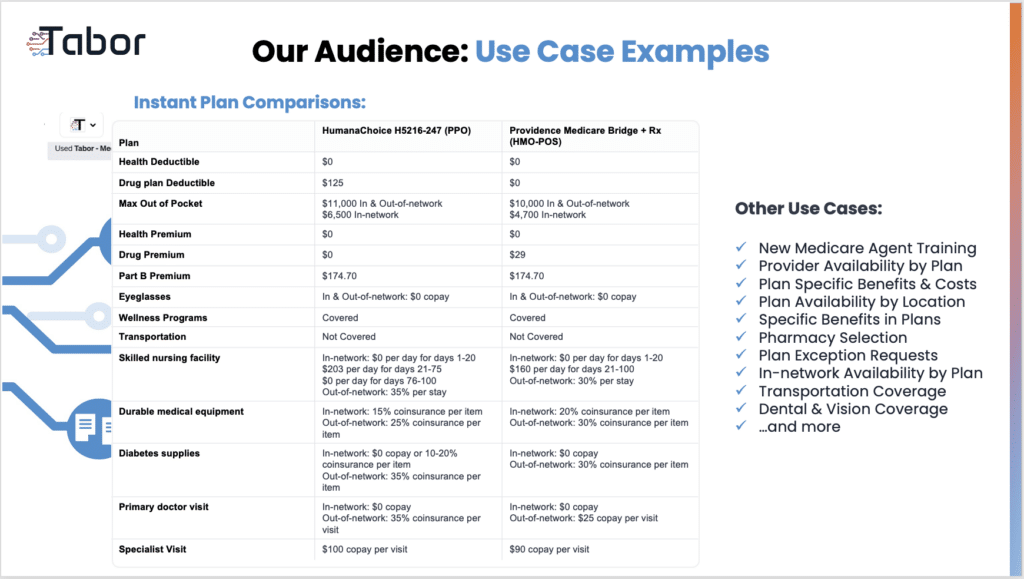

For agents, Tabor simplifies the complex process of comparing all available plans in a given market, helping them identify the most suitable option for an individual’s unique needs. This includes considering various factors like deductibles, maximum out-of-pocket expenses, premiums, supplemental benefits, and other specifics such as transportation options and food benefits.

Tabor also addresses the complexities involved in catering to seniors with chronic diseases, analyzing the best health plans for managing their specific conditions, medication requirements, and preferred healthcare providers, whether in-network or out-of-network. It evaluates numerous variables to aid in making informed decisions about healthcare coverage costs, doctor visits, and network considerations.

True AI vs. Rule-Based Engines in Insurance:

Traditional methods often limit agents to basic functions like finding providers or prescriptions, but fall short in providing detailed plan features like coverage for naturopathy, dental care, acupuncture, massage, or gym memberships. Agents typically have to sift through numerous PDF files to gather this information. Tabor, however, consolidates all necessary data in one platform, significantly empowering agents.

Traditional plan selection tools are rules-based engines, limited to responding only to what they have been programmed to know, and often lack depth in their responses. In contrast, large language models like Tabor function more human-like, capable of answering a wide range of questions with the information they are trained on. This AI technology enables users to “chat with your data,” making it feel like conversing with a human.

1. How can Generative AI be used to train and onboard Medicare agents?

Traditional training methods, likened to a slow cooker, take about 3 to 5 months for agent training. AI platforms like Tabor, on the other hand, accelerate this process dramatically, like a microwave – quick and efficient. This acceleration in training time significantly enhances productivity and reduces the time investment, which is crucial since time equates to money in this industry.

Because Tabor has a lot of the data from Medicare website, It’s all a matter of training agents how to use Tabor properly. Asking the right questions. It would probably cut it down to 5 to 10 days. It all depends on someone’s eagerness, commitment, positive attitude. And really, being excited about how to get going in this industry. So I can confidently say we could train agents 5 to 10 days

2. How Generative AI is streamlining the Medicare enrollment process.

Traditional Enrollment Process vs. AI-Enhanced Process:

In the traditional Medicare enrollment process, a veteran agent familiar with the industry can complete an enrollment in about an hour for straightforward cases with few prescriptions or medical conditions. However, for more complex situations, the process can be time-consuming, ranging from 2 to 6 hours, or even requiring a follow-up the next day. This extended duration is often due to the need for thorough research across various carrier websites to find the best plan for the client. Independent insurance agents take pride in their unbiased approach, working solely in the client’s interest.

On the other hand, using an AI tool like Tabor can significantly streamline this process. Tabor provides immediate answers tailored to the client’s specific needs, allowing agents to complete enrollments much faster.

As for the average number of policies a new Medicare agent enrolls in their first year, the range is typically around 30 to 50 applications. However, with the assistance of tools like Tabor, these figures could potentially rise to 100-200 enrollments per year. Tabor helps reduce the steep learning curve that new agents often face, enabling them to quickly become proficient and increase their enrollment rates. This shift in capability suggests that agents can significantly boost their productivity and success in the industry with the support of AI technology.

Specific examples of Medicare Agent Questions

Simple questions like determining the mail-order pharmacy for providers such as Providence or United Healthcare, understanding the allowances of a food card, or identifying plans with the best dental coverage in the Portland metro area can be easily answered by Tabor. It can also provide details on plans covering acupuncture or other specific services, effectively housing all necessary Medicare-related data.

Scenario-specific questions

Beyond basic questions, Tabor can handle more complex scenarios. For instance, it can assist in cases involving seniors with multiple chronic conditions, like COPD, who are on various medications. Tabor can determine if specific doctors are included in a network, whether a senior might need to change their doctor or hospital upon switching to Medicare, and provide detailed information about medication coverage, including tiers and copays, across different plans. This comprehensive analysis helps agents quickly find the most suitable plan for a client, considering both coverage and cost.

By leveraging Tabor’s capabilities, agents can significantly reduce their research time, allowing them to focus more on acquiring new clients and generating leads. This increased efficiency can lead to writing more policies and easing the workload of agents. The revolutionary and disruptive nature of Tabor in the industry lies in its ability to simplify and speed up the decision-making process for both agents and clients, transforming the way Medicare plans are compared and selected.

3. Proactive client engagement; beyond the enrollment process.

Plan changes in the Medicare industry, such as alterations in medications, preventative care, out-of-pocket expenses, and network changes, occur annually and can significantly affect seniors’ budgets and healthcare options. With frequent changes, including some providers not accepting certain plans, having a reliable tool like Tabor is crucial for agents to accurately advise their clients.

Successful client management involves not just acquiring new sales but also maintaining existing client relationships. As agents grow their client base, renewals often become a more significant income source than new policies. Tabor plays a vital role in this by enabling agents to efficiently review all plans, including existing ones and new options for the upcoming year, to ascertain the best fit for each client. This capability is particularly useful in scenarios like a senior moving into housing that allows for special enrollment period changes. Tabor helps agents provide personalized healthcare advice, ensuring client loyalty by demonstrating commitment and keeping clients well-informed.

Client retention is a key aspect of an agent’s role. AI tools like Tabor assist agents in staying updated with the latest products, regulations, and industry trends, enhancing their expertise and ability to provide continuous support to clients. This year-round assistance is crucial in helping clients utilize their benefits effectively. Tabor equips agents to offer superior service, fostering strong client relationships and creating loyal customers. This approach not only maintains but potentially expands the client base, making Tabor an invaluable asset in the dynamic Medicare industry.

Key Takeaways on Generative AI’s Role in the Medicare Industry:

AI is positioned as a transformative tool in the Medicare industry, enhancing agent productivity, filling industry gaps, and improving the quality of service for seniors. Embracing AI is deemed essential for staying competitive and effective in this rapidly evolving field.

AI Will Enhance Human Roles

AI, exemplified by tools like Tabor, isn’t about replacing people but about enhancing productivity and decision-making. It puts humans at the center, creating a win-win situation where both agents and seniors experience better outcomes.

AI will Help Fill Industry Gaps

AI is a vital solution to address the increasing demand and enrollment gaps projected for the future, particularly by the year 2030. With a shortfall in new agents entering the field, AI tools can help bridge this gap.

AI will Increase Senior-Centric Approach

AI keeps the focus on providing the best care and plans for seniors, ensuring optimal use of government funds and resources for Medicare.

Increasing Productivity and Efficiency

The use of AI can potentially increase productivity, efficiency, and even income, transforming agents from mere order takers to trusted advisors who offer more than just enrollment services.

Adapting to AI is Crucial

Adapting to AI can lead to significant growth, impact, and a better work-life balance for agents. She advocates for embracing AI to improve service to seniors and enhance personal fulfillment.

AI as Your Personal Assistant

AI acts like a personal assistant, handling research and administrative tasks, allowing agents to focus on advising and building relationships with clients.

If you want to stay ahead of the rapidly evolving field of data and AI, Skypoint is an invaluable resource. We are committed to educating and empowering individuals about these cutting-edge technologies that are reshaping our world every day.

We offer complimentary workshops utilizing the Microsoft stack, designed to enhance your understanding and skills. Don’t miss this opportunity to deepen your knowledge and stay ahead in the dynamic world of data and AI.