Learn how Tabor, a Medicare AI Copilot, leveraged Skypoint AI Platform (AIP) to aggregate information from over 4,000 Medicare plans from all major carriers across all 50 states.

Approximately 12,000 Americans turn 65 every day, totaling about 4 million annually. By 2030, this number is expected to reach 80 million. Despite the vast potential market, only about 100,000 out of 1.2 million licensed agents in the U.S. sell Medicare, and just 30% of these actively write policies. The opportunity is substantial, with agents earning $600 for the first year per enrollment and $300 annually for each subsequent year if the enrollee remains in their portfolio. However, there’s a high turnover rate, with 95% of agents resigning within their first year.

The challenge lies in the difficulty of starting and growing a Medicare business. Generating leads and building a client base are daunting tasks, often requiring creative and motivated efforts.

Tabor is an AI Copilot specifically for Medicare that enables health insurance agents with instant answers about the best Medicare plans for their clients, aka “Medicare AI Insurance Agent”

Tabor wanted to aggregate information from over 4,000 Medicare plans from all major carriers across all 50 states. The training data size is 5 billion token (over 2M pages of data).

Tabor partnered with Skypoint, a leading AI platform to curate and consolidate all the plan data, train the LLM and enable Medicare agents to get instant answers on the right plans for their clients using the power of generative AI.

Tabor addresses these challenges by significantly simplifying the process for agents. What traditionally takes around 6 hours of work – understanding seniors’ needs and finding the best plan for them – Tabor accomplishes in about 10 seconds. The AI tool efficiently digests information and recommends optimal plans based on individual needs.

The mission of Tabor is to become the essential tool for all Medicare agents, aiding them in efficiently placing their clients in the most suitable insurance scenarios. This innovation not only benefits the agents in terms of productivity and ease of work but also ensures that seniors receive the best possible plans tailored to their specific needs.

What traditionally takes around 3 hours of work – understanding seniors’ needs and finding the best plan for them – Tabor AI Copilot accomplishes in about 30 minutes.

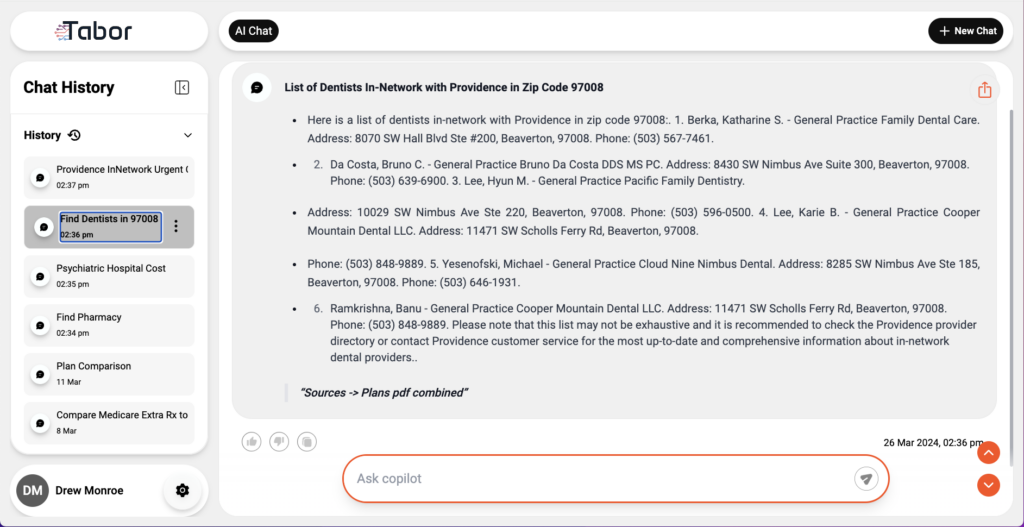

Tabor functions as a specialized large language model (LLM) focused specifically on Medicare and related policies across the United States. The model is continually updated with extensive information on Medicare plans, tailored to each county as defined by the Centers for Medicare & Medicaid Services (CMS). This involves processing a massive amount of documentation to track the various health plans for each county nationwide.

By ingesting this data into the large language model, Tabor becomes a highly efficient tool for agents, trained to provide detailed and specific answers about health plans in every U.S. county. It assists agents in various tasks, such as summarizing information, comparing plans, and updating coverage changes. Tabor can handle a range of inquiries, including provider portals, pharmaceutical details, and more, using publicly available data. It stands out for its precision, accuracy, and speed.

Train & Onboard New Agents

Traditional training methods take about 3 to 5 months for agent training. AI platforms like Tabor, on the other hand, accelerate this process dramatically. This acceleration in training time significantly enhances productivity and reduces the time investment, which is crucial since time equates to money in this industry.

Because Tabor has Medicare plan data from nationwide plans, It’s all a matter of training agents how to use Tabor properly. Asking the right questions, It would probably cut training down to 5 to 10 days. It all depends on someone’s eagerness, commitment, positive attitude. And really, being excited about how to get going in this industry. So I can confidently say we could train agents in 5 to 10 days.

Streamline Medicare Enrollment

In the traditional Medicare enrollment process, a veteran agent familiar with the industry can complete an enrollment in about an hour for straightforward cases with few prescriptions or medical conditions. However, for more complex situations, the process can be time-consuming, ranging from 2 to 6 hours, or even requiring a follow-up the next day. This extended duration is often due to the need for thorough research across various carrier websites to find the best plan for the client. Independent insurance agents take pride in their unbiased approach, working solely in the client’s interest.

On the other hand, using an AI tool like Tabor can significantly streamline this process. Tabor provides immediate answers tailored to the client’s specific needs, allowing agents to complete enrollments much faster.

As for the average number of policies a new Medicare agent enrolls in their first year, the range is typically around 30 to 50 applications. However, with the assistance of tools like Tabor, these figures could potentially rise to 100-200 enrollments per year. Tabor helps reduce the steep learning curve that new agents often face, enabling them to quickly become proficient and increase their enrollment rates.

New Medicare agents enroll around 30 to 50 applications in their first year. With Tabor AI Copilot, these figures could potentially rise to 100-200 enrollments per year.

Proactive client engagement; beyond the enrollment process.

Plan changes in the Medicare industry, such as alterations in medications, preventative care, out-of-pocket expenses, and network changes, occur annually and can significantly affect seniors’ budgets and healthcare options. With frequent changes, including some providers not accepting certain plans, having a reliable tool like Tabor is crucial for agents to accurately advise their clients.

Successful client management involves not just acquiring new sales but also maintaining existing client relationships. As agents grow their client base, renewals often become a more significant income source than new policies. Tabor plays a vital role in this by enabling agents to efficiently review all plans, including existing ones and new options for the upcoming year, to ascertain the best fit for each client. This capability is particularly useful in scenarios like a senior moving into housing that allows for special enrollment period changes. Tabor helps agents provide personalized healthcare advice, ensuring client loyalty by demonstrating commitment and keeping clients well-informed.

Client retention is a key aspect of an agent’s role. Tabor assists agents in staying updated with the latest products, regulations, and industry trends, enhancing their expertise and ability to provide continuous support to clients. This year-round assistance is crucial in helping clients utilize their benefits effectively. Tabor equips agents to offer superior service, fostering strong client relationships and creating loyal customers. This approach not only maintains but potentially expands the client base, making Tabor an invaluable asset in the dynamic Medicare industry.